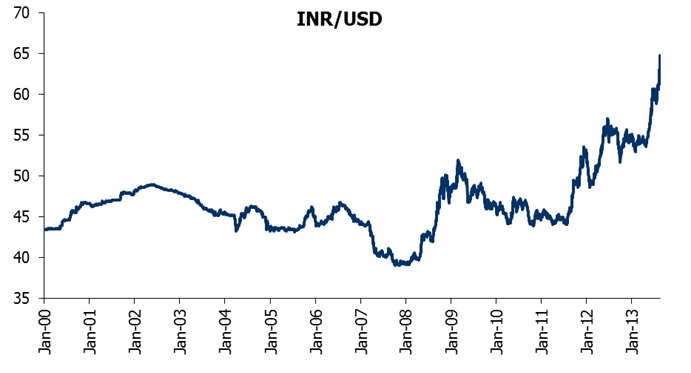

The Indian Rupee (INR) is one of the worst performing currencies in the world during 2013 (Table-1). At Rs.65.5/USD it slid by a whopping 19.8% in 2013 (so far) after sliding down by 4% during 2012. The month of August was especially devastating. Since 2000, the current rupee level is the highest ever seen (look at the graph). From a low of Rs.39/dollar in Feb 2008, the Rupee is close to Rs.65.5/dollar. Repeated efforts by RBI to stem the rot went in vain so far. The trigger for such a dramatic fall has been attributed to US decision to roll back the Quantitative Easing (QE) as US economy has started showing signs of a pickup.

The following questions emerge out of this:

- Why did the rupee depreciate so fast?

- How does it affect various people?

- What is the further downside and where can it settle?

- What is the long-term prospect of Rupee? &

- What should be the strategy?

Let me try and answer them one by one:

1. Why did the Rupee depreciate so fast?

Technically rupee depreciates against the dollar when people sell rupee and buy dollars. And when people sell rupees and buy dollars, it results in negative capital flows and leads to downward pressure on the currency (and vice-versa). The following reasons can be explored:

- US Monetary Policy

- Slowing Indian Economy

- Ineffective RBI

- Corporate Debt and Hedge &

- Weak domestic equity market

US Monetary Policy

The US Fed initiated a series of monetary easing programs more commonly known as Quantitative Easing (QE) which created copious amounts of liquidity in the global market. The simple idea behind QE is to purchase government bonds in order to keep the yields low, as low interest rate will then help economy recover. Now that the US economy is showing signs of recovery, the Fed has announced its intention to taper the QE i.e, stop buying the bonds. In response to this news, the bond yields started moving up and capital has started moving back to US in search of safety. In other words, capital left markets like India, Brazil, etc and is going back to US.

Result: Investors flee other currencies and take shelter in US Treasuries (the so called safe haven) causing USD to strengthen and other currencies to weaken

Slowing Indian Economy

The Indian economy, which was once heralded as the next big thing by economists around the world, has lost its sheen and grew by a decade low of around 5% in 2012-2013.

Indian economy’s deficit is spiraling out of control. Both the fiscal deficit (expenditure more than income) and current account deficit (imports more than exports at a simple level) are headed for further deterioration during 2013 and next. While the fiscal deficit is at 4.9% of GDP, the current account deficit is at 4.8% in the year 2012-13. The current account deficit is triggered primarily by trade deficit (Export-Import). Not only our imports exceed exports, but even within the imports the dominance is by oil and gold imports, something very difficult to control. Lack of progress in deficit reduction is causing poor foreign investor confidence which contributes to negative capital flows (meaning foreigners taking their money out of the country). The deficit is a long-term problem especially the fiscal deficit. No matter which government is in place, populist policies will continue as a tool to gain votes and this will ensure that the deficit does not come down. However, if they do not go up, then that itself will be good news. Also, during the past few years, Indian government has attained notoriety for governance lapses (2G scam, etc) and policy missteps. Revising the IT Act retrospectively from 1962 in order to bring Vodafone to book was a huge blow to the confidence in our legal structure to foreign investors. Also, there were several governance failures that keeps India in the wrong side of the news globally (a good indication is the number of negative articles that appear in The Economist).

Result: Foreign investors exit by selling rupees and buying dollars

Ineffective RBI

Reserve Bank of India is tasked with ensuring the financial stability of the economy and hence is the sole inventor of the monetary policy. In the past, when currency encountered volatility or undue fluctuations, RBI used its foreign exchange reserves to intervene in the market (through purchase or sale of dollars) and thereby reduce the volatility of the currency. However, this time around, they raised their hand and declared openly their intention not to interfere in preventing the rupee slide. This may be due to limited foreign exchange reserves currently at $277 billion enough to cover only 7 months of imports. For China, it amounted to $3,500 billion and represented 21 months of import cover, a far comfortable situation to be in.

Instead, during the July and early August meetings, the RBI intervened by tightening the monetary policy. It increased the short term rates by hiking the marginal standing facility by 200 basis points. This further exacerbated the situation with the current economic conditions. During its latest meeting, it signaled a reversal of this tightening policy. Hence, we can clearly understand the predicament of RBI to intervene. While RBI has not interfered directly, it has taken several steps to contain the situation:

- It now requires exporters to repatriate 50% of export earnings placed in special accounts

- Restrictions on investments done abroad by Indian companies and citizens.

- Limits on intraday net open positions of foreign exchange dealers

- Restricting currency derivatives (to check speculation)

- Hiking the interest rate on NRI foreign currency deposits as well as rupee deposits

The major news that has hit the street and has buoyed sentiments of investors, corporates and economists alike is the appointment of Raghuram Rajan as the new Governor of RBI. The former chief economist of IMF is known for his famous prediction of the 2008 global financial crisis and is widely tipped to steer the Indian economy back to growth. In his first address as the RBI Governor, he hinted at the RBI taking actions to save the rupee (although his primary focus is on inclusive growth and development, as well as financial stability).

Following were the key measures that he alluded to for rupee stabilization on the first day of his office:

- More settlement of import trades in rupee which will help in lesser usage of dollars.

- Special swap window for Foreign Currency Non Resident Deposit B (FCNR B) to reduce cost of funds of banks by at least 250 basis points.

- Raising of Banks’s unimpaired Tier I capital to 100% from the current 50%.

Result: RBI has no arsenal to arrest the slide immediately but is using other indirect means. Hope for appreciation of the rupee from the reforms taken by the new Governor.

Corporate Hedge & Debt

Many Finance Managers, while managing their foreign exchange exposure, turned quite easy and relaxed due to continued rupee strength during the last few years especially during 2010 when rupee was averaging say 45 (you don’t need to hedge when rupee is strengthening if you are an importer and vice-versa). They expected this to continue forever and hence did not bother to hedge their currency risk exposures. Also, many of them resorted to foreign currency borrowing mostly in short-term maturities from European banks disregarding the rupee depreciation danger. However, when rupee started falling (much against their expectations) they were caught off guard and ran for cover to hedge their exposure which led to intense buying of dollars leading to its appreciation. Now many short-term corporate debt is coming up for repayment which will also witness more dollar buying adding to the rupee pressure. Also, the ability to rollover the debt will be limited by European banks due to the European crisis.

Result: Companies will have to find dollars to repay their debt and incur loss due to unhedged positions

Weak Domestic Capital Market

The Indian equity market has not been able to attract investments from Foreign Institutional Investors (FIIs) due to the weak economy and the poor performance by Indian corporates. Although the equity market has seen FII inflow of around $12 billion till August 2013, it has witnessed net FII outflow of $3.1 billion from June till August 2013 which has exacerbated the fall in the rupee. If you look at Table 2 the outflow seem to be more on debt than on equity. If this trend continues, it will result in the further depreciation of the rupee.

Result: FIIs will continue to shun Indian equity unless the economic conditions become more favorable.

2. How does it affect various people?

A rupee weakness affects the following:

- Importers (as they have to pay more rupees for the same dollar)

- Economic image of the country (not able to arrest the fall)

- Existing foreign investors (their investments are worth less now) &

- Residents (in the form of say high oil price)

On the other hand, it benefits the following:

- Exporters (as they get more rupees for the same dollar)

- Non-resident Indians (NRI’s) (as they get more rupees for the same dollar)

3. What is the further downside and where will it settle?

While domestic weakness in terms of low growth, high deficit, high inflation has contributed to the falling rupee, we should also blame the global financial crisis accentuating the problem for us especially Europe. This has caused many currencies in the world to fall (see Table 1, Brazil) apart from India. RBI is playing a sensible role of not exhausting our foreign exchange reserves and is allowing the market to determine the level of rupee. If required, it could call on SBI to raise external financing from NRI’s like how it did in 1998 and 2000 (remember the Millennium bonds!). However, the days of Rs.50-55 are gone. Political weakness is expected to continue with weak policy responses on all issues especially with the elections around the corner. There is no quick solution to deficit problems and inflation. In terms of where they will settle, Rupee is a moving target and hence it cannot settle anywhere. In terms of calls, investment banks place at from a pessimistic Rs. 70 to an optimistic Rs. 60 in the next 6-12 months.

Rupee Predictions by various Financial Institutions

Deutsche Bank – Rs. 70 (one month)

CRISIL – Rs. 60 (by Mar 2014)

Barclays – Rs. 61 (next 6-7 months)

UBS – Rs. 70

Credit Suisse – Rs. 65

4. What is the long-term outlook for the Rupee?

The current Rupee bash has raised some structural questions about the long-term potential of the Indian Rupee. Any call on the Indian Rupee is a function of the long-term performance of the Indian economy and the impact of global crisis in as much as it has an impact on India. India, along with China, is among the fastest growing economies in the world even after taking the current dip in growth. Given the right leadership, and reforms, the economic potential of India is certainly good. India is among a very select few countries in the world which does not have any sovereign borrowings in foreign currency. All its debt are domestic though Indian companies have foreign debt. Hence, the current abyss can not only be stopped but can be reversed with some wise leadership and policy reforms. With respect to global crisis, it cannot be predicted as to when and where it can arise. There are several pressure points in the world and anything can erupt anytime to cause tremors in emerging markets like India. Only sound monetary and fiscal policy can save the day for India.

5. What should NRI’s dp?

The rupee currently trades at Rs.230/KD after touching a high of Rs.240 on August 28th. From the level of.190/KD seen during May 2013, this represents a fall of nearly 25% within a span of 4 months, something that has never happened before. Therefore, for non-resident Indians, this probably is the best time to remit money to India. If you have dollar investments, it will be wise to exit the position and remit the money back to India. If you have rupee denominated debt, this probably is the best time to partly or fully wind it down using remittance from abroad. However, borrowing in local markets to remit money to India may be a dangerous strategy as this involves taking calls on both currency and interest rates, the two most difficult things to predict in life!