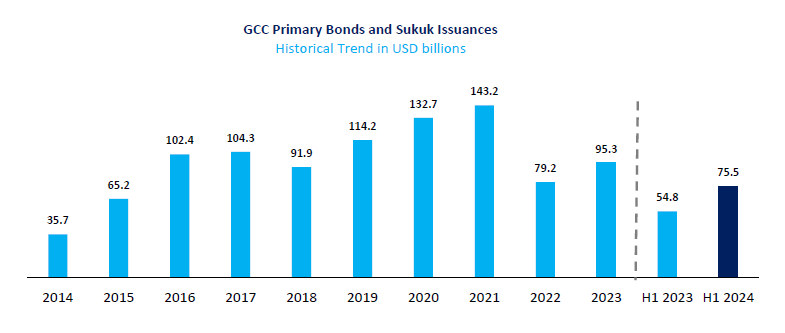

In its Fixed Income Report, Markaz states that Primary debt issuances of Bonds and Sukuk in the Gulf Cooperation Council (“GCC”) Countries amounted to USD 75.5 billion during H1 2024 compared to USD 54.8 billion raised in H1 2023, representing a 38% increase. During H1 2024, there were 173 primary debt issuances including fixed and floating rate tranches compared to 130 issuances in H1 2023.

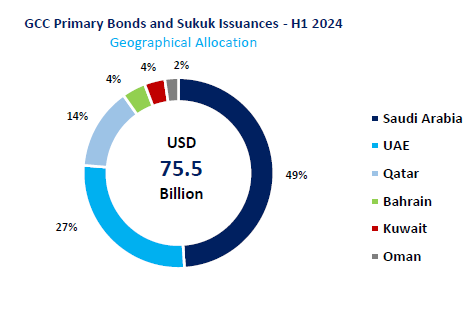

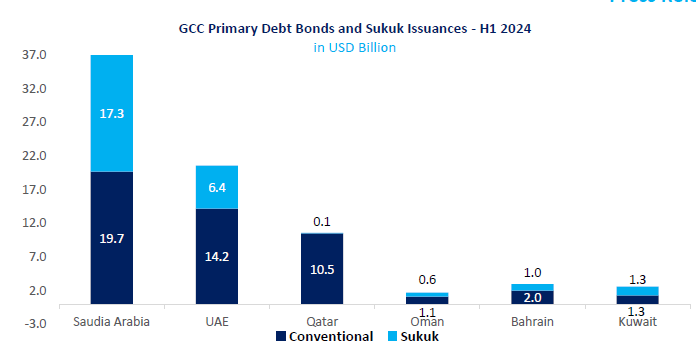

Issuances by Geography: Saudi-based issuers led the GCC Bonds and Sukuk market during the half, raising a total of USD 37.0 billion through 44 issuances, representing 49% of the total value raised in the GCC, followed by UAE issuers which raised USD 20.6 billion with 64 issuances, representing 27%. Qatar entities raised a total of USD 10.5 billion through 39 issuances, representing 14%, while Bahraini Entities witness 4 issuances raising USD 3.0 billion representing 4% of the market. Omani entities raised a total of USD 1.7 billion representing 2% of the total new amount issued during H1 2024. Kuwaiti Entities raised a total of USD 2.6 billion through 15 issuances representing 4% of the market.

Sovereign vs. Corporate: Issuances by Sovereign entities in the GCC made up 55% of the total value of GCC primary issuances during H1 2024, amounting to USD 41.5 billion and up 77% from H1 2023. Primary issuances by Corporates amounted to USD 34.0 billion during the half constituting 45% of the total value of GCC primary issuances and marking a growth of 8% compared to H1 2023.

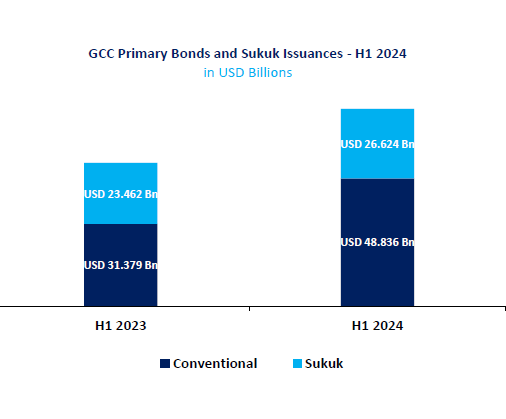

Conventional vs. Sukuk: Conventional issuances increased by 56% in H1 2024 compared to the same period last year, raising a total of USD 48.8 billion representing 65% of the total value of primary issuances in the GCC. On the other hand, Sukuk issuances amounting to USD 26.6 billion made up 35% of the total value of primary issuances during H1 2024 and recording a 14% increase from the same period last year.

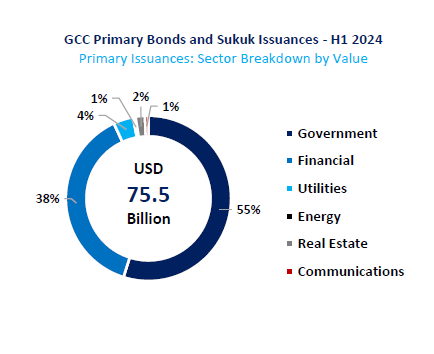

Sector Segmentation: The Government sector accounted for the largest amount of primary debt issuances by value, raising a total of USD 41.5 billion, or 55% of the total value of issuances in the GCC in H1 2024, followed by the financial sector (including quasi-government entities) that raised a total value of USD 28.8 billion, representing 38% of the total amount issued.

Maturity Profile: Perpetual issuances dominated the GCC debt capital markets by total value, with a total of USD 28.6 billion, or 38% of the total value of issuances. Issuances with tenors of less than 5 years (LT5 years) came in second with a total value raised of USD 19.9 billion, or 26% of the total value of issuances.

Issue Size Profile: The size of GCC Bonds and Sukuk primary issuances during the half ranged from USD 545 thousand to USD 5.0 billion. Issuances with principal amounts greater than or equal to USD 1 billion raised the largest amount totaling USD 48.7 billion, representing 65% of the total primary issuances.

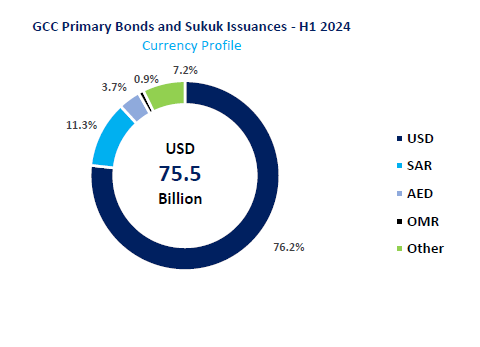

Currency Profile: US Dollar-denominated issuances led the GCC Bonds and Sukuk primary market in H1 2024, raising a total of USD 57.5 billion or 76% of the total value of GCC primary issuances. This was followed by Saudi Riyal denominated issuances that raised a total of USD 8.5 billion or 12% of the total value of issuances in the GCC.

Rating: In H1 2024, a total of 75% of GCC primary Bonds and Sukuk issuances (in terms of value) were rated by either one of the following rating agencies: Standard & Poor’s, Moody’s, Fitch and/or Capital Intelligence, of which 71% were rated within the Investment Grade.

.png)

Markaz GCC Bonds and Sukuk Market Report.pdf

Markaz: GCC Fixed Income markets see USD 75.5 billion in primary issuances during H1 2024 representing a 38% increase from the same period last year

22/07/2024