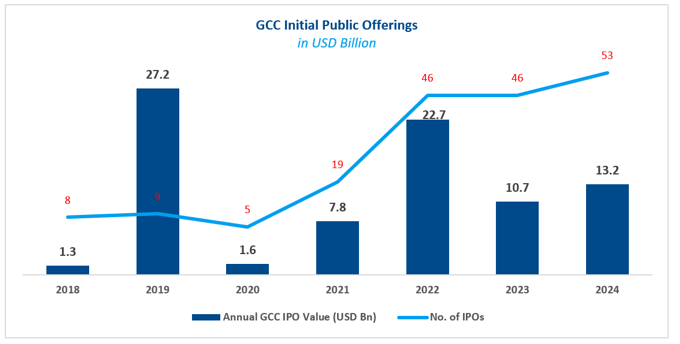

Markaz released its research report titled “Initial Public Offerings (IPO) in the GCC markets”, stating that the region has seen 53 offerings during the year 2024 raising a total of USD 13.2 billion in proceeds, marking a 23% increase compared to the previous year, where issuers raised USD 10.7 billion through 46 offerings. Corporate IPOs raised USD 8.9 billion, or 67% of the total GCC IPO proceeds during the year, through 48 offerings. While IPOs offered by government related entities only accounted for 33%, amounting to USD 4.3 billion through 5 offerings.

Geographical Allocation:

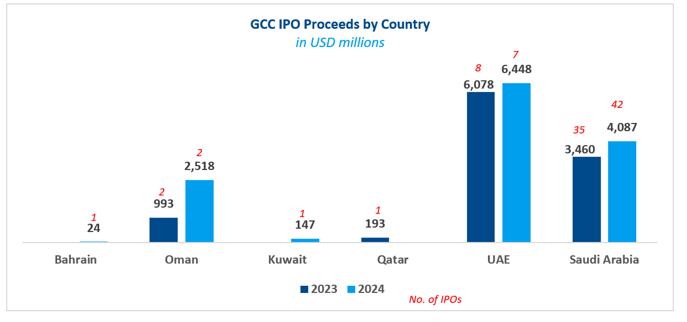

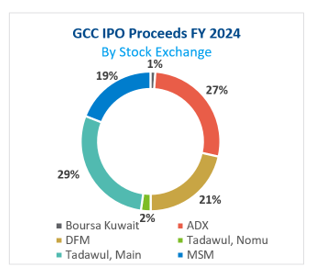

Markaz’s report stated that the UAE led the region in terms of IPO proceeds for the third year in a row, raising a total of USD 6.4 billion which constituted 49% of the total GCC IPO proceeds during the year. The Emirates saw 7 IPOs during the year where Abu Dhabi Securities Exchange (ADX) raised USD 3.6 billion hosting 4 IPOs led by NMDC Energy and Lulu Retail Holdings. On the other hand, Dubai Financial Market (DFM) raised a total of USD 2.8 billion from Talabat, Parkin Company and Spinneys IPOs.

Saudi Arabia followed, raising a total of USD 4.1 billion, or 31% of the total GCC IPO proceeds, with 42 offerings. Saudi Exchange (Tadawul) saw 14 IPOs on its Main Market amounting to a total of USD 3.8 billion and 28 IPOs on its Parallel Market (Nomu) raising a total of USD 297 million. Dr. Soliman Fakeeh Hospital, Almoosa Health Group and Nice One IPOs were the largest offerings listed on Tadawul this year.

Oman raised USD 2.5 billion during the year, or 19% of the total GCC IPO proceeds, witnessing two IPOs on Muscat Securities Market (MSX). Offerings by OQ Exploration and Production (OQEP) and OQ Base Industries (OQBI) were held during the last quarter of the year, in alignment with the Oman Investment Authority's strategy to divest certain government assets. It is worth noting that OQEP is the largest IPO in Oman’s history raising a total of USD 2.0 billion for a 25% stake.

Kuwait has seen its first IPO since 2022, with Boursa Kuwait hosting the IPO of Beyout Investment Group Holding during the second quarter of the year. The offering raised a total of USD 147 million constituting 1% of the total GCC IPO proceeds raised during the year.

Bahrain have placed one IPO during the year raising a total of USD 24 million. Bahrain Bourse (BHB) welcomed the IPO of Al Abraaj Restaurants Group marking Bahrain’s first IPO since 2018. The company offered 35% stake with proceeds constituting to 0.2% of the total GCC IPO proceeds during the year.

Sector Allocation:

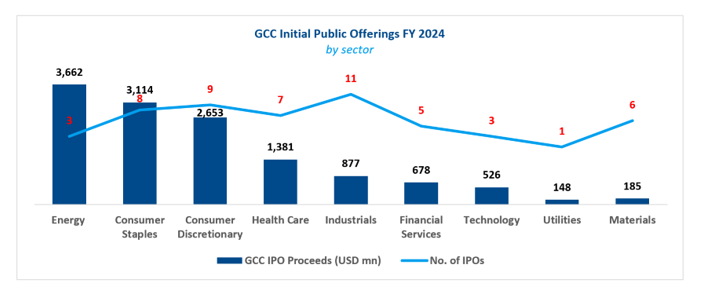

The Energy sector raised a total of USD 3.7 billion, accounting for nearly 28% of the total proceeds during 2024 from offerings by Abu Dhabi’s NMDC Energy and Oman’s OQEP and OQBI. This was followed by the Consumer Staples sector with USD 3.1 billion, or 24% of the total proceeds, from 8 IPOs including Lulu Retail Holdings, Spinneys and Saudi Modern Mills Company. The Consumer Discretionary sector raised a total of USD 2.7 billion, constituting 20% of the total proceed, from 9 IPOs including Talabat, Nice One and Abu Dhabi National Hotels Catering.

Moreover, the Healthcare sector saw USD 1.4 billion in proceeds, constituting 10% of the total proceeds, through 7 IPOs while the Industrials sector saw USD 877 million from 11 offerings and constituting 7% of the total GCC IPO proceeds during the year. This was followed by the Financial Services sector, Technology, Utilities and Material which constituted 5%, 4%, 1% and 1% of total offerings respectively.

Post-Listing Performance:

Excluding December listings, more than 59% of the GCC IPOs shares surged on their first 30 days post-listing. Saudi Arabia’s IPOs, on both the Main and Parallel markets, recorded the highest performances post-listing compared to other GCC markets. Positive market sentiments for sectors such as technology, healthcare and consumer drove the strong gains for these IPOs. Miahona Company recorded the biggest gains with its shares rising more than 147% compared to its offering price of SAR 11.5. The company floated 30% of its capital on Tadawul’s Mian Market in May 2024. This was followed by Purity for Information Technology Company which gained 118% on its first 30 days after offering a 20% stake for SAR 8 on Tadawul’s Parallel Market (Nomu) in October 2024.

On the other hand, some IPOs have recorded negative performance noting that majority of which were minor declines. The largest decline recorded was Pan Gulf Marketing Company which was listed on Nomu in February 2024. The shares dropped by 35% after its offering price at SAR 51. Yaqeen Capital Company has also underperformed, slumping by 28% from its offering price of SAR 40 in June 2024. A negative trend was seen as well across milling companies, all of which dropped, which might be due to investors being skeptical over government’s support for this industry.

GCC Markets Performance

Most of the GCC equity market indices ended the year 2024 on the rise. Dubai Financial Market outperformed its GCC peers with a 26.9% increase followed by Boursa Kuwait with a 12.4% increase. Muscat Securities Market increased by 1.3% similarly to Bahrain Bourse which increased by 1.2%. Saudi Tadawul increased by 0.6% while Qatar Stock Exchange fell by -1% as well as Abu Dhabi Securities Exchange which fell by -1.7%.

GCC IPO Pipeline:

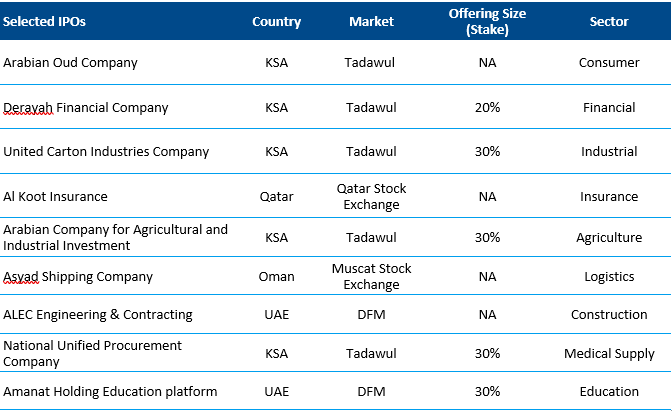

Saudi Arabia is expecting more than 50 IPOs during the next two years. Seven IPOs have already gained regulatory approvals and are expected to be listed by the first quarter of 2025. The UAE, Qatar and Oman are also expecting several IPOs as local companies started appointing banks for potential offerings.

GCC IPO Report FY 2024

Markaz: GCC IPOs raise USD 13.2 billion in 2024

19/01/2025