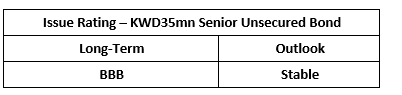

Markaz announced that Capital Intelligence Ratings (CI Ratings or CI) has affirmed the ‘BBB’ issue rating assigned to Markaz’s KWD35mn Senior Unsecured Bond due 2025. The Outlook on the rating remains Stable.

The issue rating is driven by Markaz’s resilient financial metrics in terms of both liquidity and debt profile with the latter improving in 2023 through a significant reduction of bank borrowings. Other supporting factors are the good debt maturity profile, the high level of unencumbered assets and the maintenance of substantial unutilised – but committed – funding lines. The rating also reflects the issuer’s well-established franchise and good reputation in the region, especially in Kuwait. The experienced management team has demonstrated its ability to effectively navigate the Company through many challenging operating environments and market cycles. As the bond does not contain any structural credit enhancements or result in a degree of effective subordination, the issue rating is in line with our assessment of the issuer’s general capacity to meet its senior unsecured obligations.

Notwithstanding its relatively small size, Markaz has a strong reputation as a fund manager in Kuwait. Its portfolio of AUM continued to grow in 2023 and accelerated in H1 24 with the recovery of the financial markets. It has retained its sound market share and its position among the top fund managers domestically.

While financial markets were subdued in 2023, real estate market conditions were generally more favourable especially in the GCC. Consequently, the Company exited and disposed of a number of investment properties. Together with a large drop in cash balances and deposits with banks, its asset base contracted sharply in 2023. There were also some shifts between asset classes as a number of financial investments were reclassified to investment in associates. Nonetheless, the asset composition in 2023 was stable with the portfolio of financial assets at FVTPL forming close to half of total assets. This portfolio is fairly liquid as reflected by the high proportion of Level 1 and 2 fair value investments.

Liquidity and Short-Term Debt Repayment Capacity

Notwithstanding the negative operating cashflow, the Company’s liquidity position is considered good and remains supported by its large portfolio of fairly liquid financial assets at FVTPL. It also continues to maintain a substantial amount of unutilised but committed lines and its assets remain largely encumbered. The Company continued to maintain a good debt maturity profile. Its short-term debt obligations were more than covered by cash balances and deposits with banks in both 2023 and H1 24.

As for earnings, due to its business model and given the large portfolio of financial assets at FVTPL, Markaz’s earnings will remain volatile in line with the movements of the financial markets. While fee and asset management income declined in 2023, net profit nearly doubled on the back of the large gain from the disposal of investment properties. Going forward, the Company is expecting a solid net profit for this year given the still bullish financial markets, as well as some smaller sales of investment properties. Profitability metrics have remained erratic in line with the trend of the industry, and better than those of its immediate and largest peer in Kuwait.

Rating Outlook

The Stable Outlook indicates that the issue rating is likely to remain unchanged over the next 12 months. The outlook balances challenges relating to the effect of financial markets volatility against the Company’s generally sound financial standing, solid liquidity, and well-established franchise and market reputation.

Ratings:

‘BBB’ Issue Rating Affirmed with a Stable Outlook for Markaz’s Senior Unsecured Bond Due 2025

09/12/2024