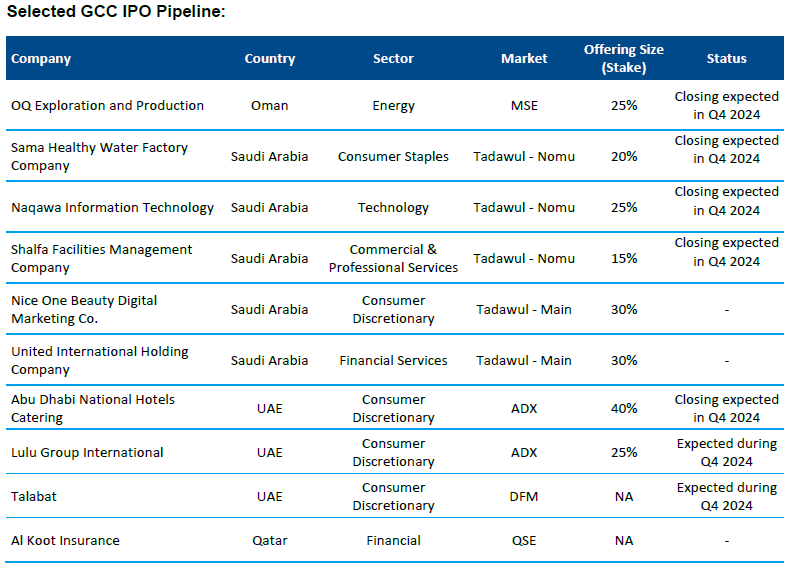

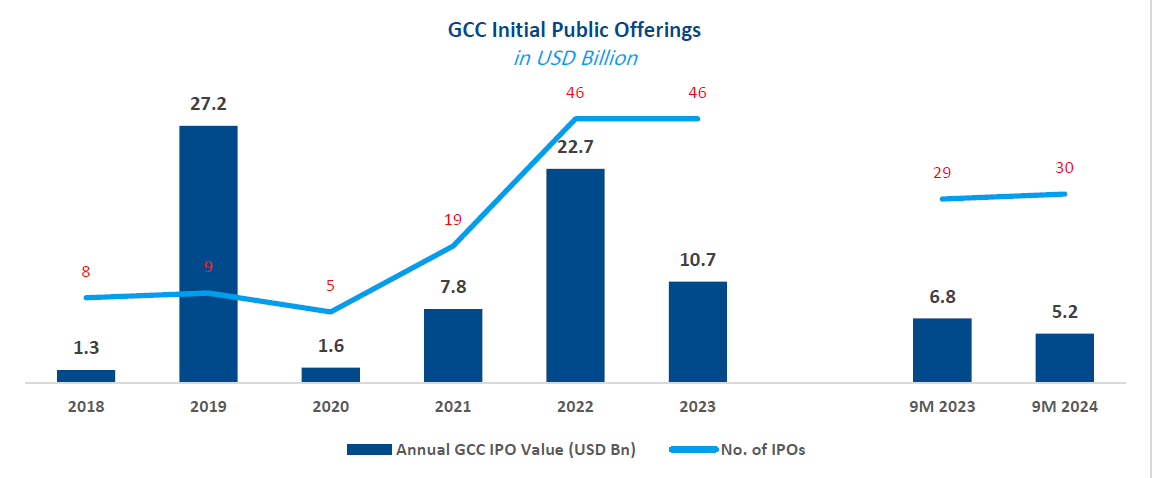

Markaz released its research report titled “Initial Public Offerings (IPO) in the GCC markets”, stating that the region has seen 7 offerings during the third quarter of 2024 raising a total of USD 1.7 billion in proceeds, marking a 6% increase compared to the third quarter of last year. During the first nine months of 2024, the GCC issuers have raised a total of USD 5.2 billion through 30 offerings compared to the same period of 2023, where issuers raised USD 6.8 billion through 29 offerings.

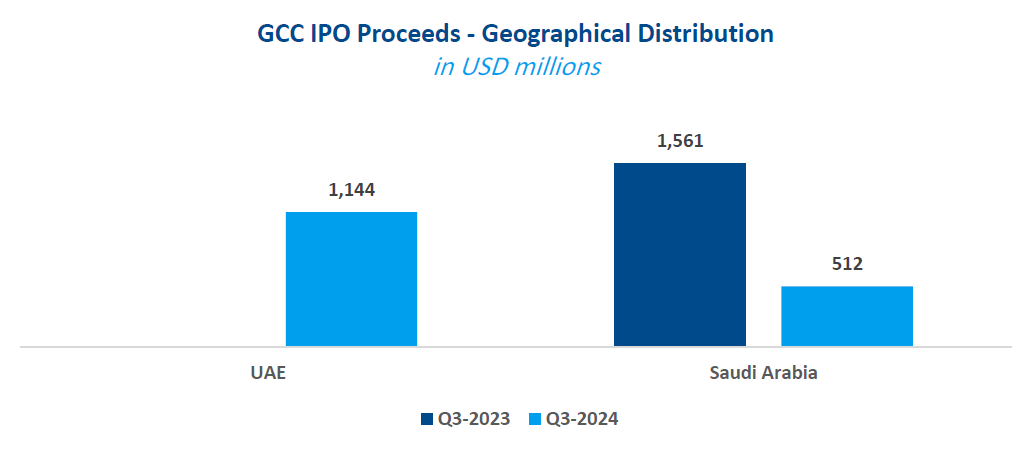

Geographical Allocation:

Markaz’s report stated that the UAE led the region in terms of IPO proceeds during the third quarter, raising a total of USD 1.1 billion from 1 offering constituting 69% of total GCC IPO proceeds during the quarter. Saudi Arabia’s IPO proceeds totaled USD 512 million during the quarter with 6 offerings constituting 31% of total GCC IPO proceeds during the quarter.

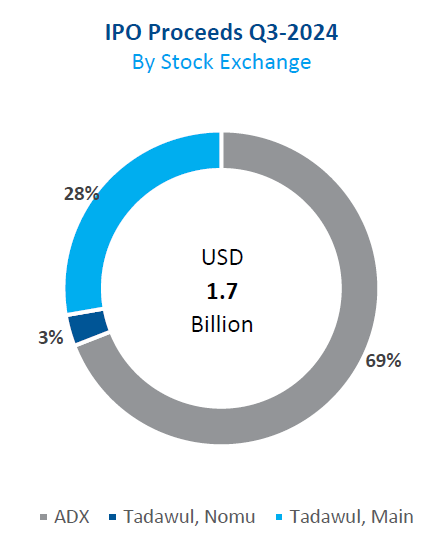

Exchange Allocation:

Abu Dhabi Securities Exchange (ADX) recorded 69% of the total Q3 IPO proceeds with the total value of USD 1.1 billion listed on its Main Market. Saudi Arabia’s Tadawul saw a total of USD 459 million and USD 53 million listed on its Main Market and Nomu-Parallel Market respectively, together constituting 31% of the total GCC IPO proceeds. Other exchanges in the GCC have not seen any listings during the quarter.

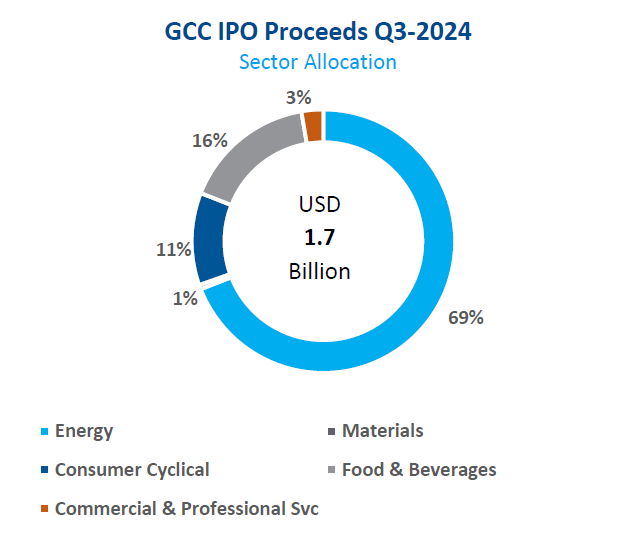

Sector Allocation:

The Energy sector accounted for nearly 69% of the total proceeds during the quarter through one offering amounting to a total of USD 1.1 billion in proceeds. The F&B sector raised about USD 271 million constituting 16% of total GCC IPO proceeds raised during the quarter. The Consumer Cyclical sector constituted 11% of the total proceed from one IPO amounting to USD 188 million. Moreover, the Commercial and Professional Services sector saw 3 IPOs constituting 3% of the total proceeds amounting to USD 44 million while the Materials sector saw one IPO amounting to 9 million and constituting 1% of the total GCC IPO proceeds during the third quarter of the year.

Q3-2024 IPOs:

Shares of NMDC Energy jumped by 8% from the offer price of AED 2.8 on its trading debut on ADX, marking the largest IPO during the quarter. The company sold 23% stake for a total of USD 1.1 billion and was oversubscribed 31.3 times. The shares were listed on ADX’s Main Market on the 11th of September 2024.

Al Majed for Oud jumped by 30% from the offer price of SAR 94 on its trading debut. The company sold a 30% stake for USD 188 million and had been oversubscribed 156.5 times. The company was listed on Tadawul’s Main Market on 7th of October 2024.

Arabian Mills for Food Products shares slumped by 0.3% from the offer price of SAR 66 on its trading debut. The company sold a 30% stake for a total of USD 271 million and was oversubscribed by 132 times the offered amount. The company was listed on Tadawul’s Main Market on 8th of October 2024.

First Avenue Real Estate Development Company IPO raised a total of USD 26.3 million after offering 8% stake at a price of SAR 6. The offering was 7.4 times oversubscribed. The company’s shares are yet to be listed on Tadawul’s Nomu-Parallel Market.

Tadawul has also hosted the IPO of Altharwah Albashariyyah Company which raised a total of USD 11.7 million. The company sold a 15% stake and saw a 1.1 times oversubscription. On its debut on Tadawul’s Nomu-Parallel Market, the company’s shares plunged by 7% from the offer price of SAR 62. The shares were listed on 27th of August 2024.

ASG Plastic Factory Company IPO raised a total of USD 8.8 million in proceeds. The company offered a 20% stake which was covered 3.2 times. The shares surged 11% from the offer price of SAR 44 on its trading debut. The company was listed on Tadawul’s Nomu-Parallel Market on 18th of August 2024.

Al Ashghal Almoysra Company jumped by 4% from the offer price SAR 50 on its trading debut. The company sold 20% stake for a total of USD 6.4 million which was covered 4.3 times. The company was listed on Tadawul’s Nomu-Parallel Market on 24th of July 2024.

GCC-IPO-Report-Q3-2024.pdf

Markaz: GCC IPOs raise USD 1.7 billion in Q3 2024

23/10/2024